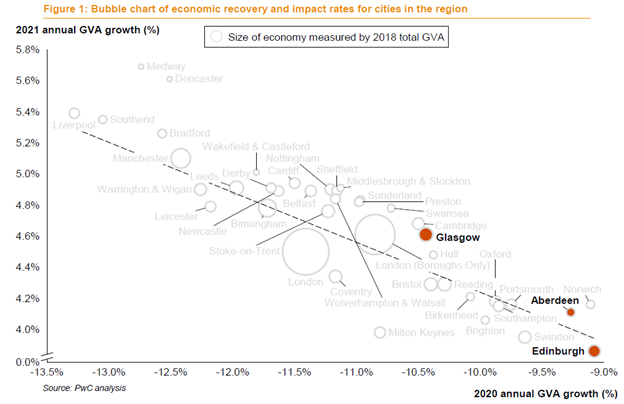

Edinburgh is the UK city least impacted economically by the COVID-19 pandemic, according to the latest Demos-PwC Good Growth for Cities report, with Glasgow being the hardest hit city in Scotland.

The Scottish capital is expected to see its economy shrink by -9.1% in 2020, a less severe impact than in any other UK city, due to its sectoral mix and relatively low case rate. In Glasgow, the economic decline in 2020 is expected to be -10.4%. By contrast, the average annual economic growth rate for cities in Scotland is -9.7% in 2020, better than the UK average rate of -11.0%.

The economic recovery profiles north and south of the Border are more similar, with Aberdeen’s economy predicted to grow by 4.1% this year, and Glasgow by 4.6%. With 3.9% growth forecast, Edinburgh will be one of the slowest cities to recover.

The Demos-PwC Good Growth for Cities Index ranks 42 of the UK’s largest cities based on the public’s assessment of 10 key economic wellbeing factors, including jobs, health, income and skills, as well as work-life balance, house affordability, travel-to-work times, income equality, environment and business start-ups.

PwC’s GVA analysis took into account a city’s sectoral make-up, the impact of the use of the furlough scheme to protect jobs, and rates of Universal Credit claims, COVID-19 infection and mobility rates to project GVA growth rates for 2020 and 2021.

The report finds that UK cities and towns hardest hit by the economic fallout from the pandemic are likely to make the fastest recovery, but are still expected to be worse off than at the beginning of the pandemic compared to more resilient places.

While there will be bounce back for hard-hit cities, recovery will not necessarily instigate an increase in economic activity – leaving low-performing cities worse off than at the beginning of the pandemic compared to more resilient places.

The Good Growth for Cities report calls for the UK’s recovery to look beyond national GDP and double-down on efforts to address the individual challenges facing towns and cities to level-up inequalities.

Analysis is based on the ‘Gross Value Add’ (GVA) of each local area, reflecting the make-up of local economies and the prevalence of different industries.

The Good Growth for Cities research highlights that addressing structural issues – such as improving local skills, encouraging new business development and addressing local environmental challenges – will enable cities and towns to achieve longer-term good growth than traditional economic measures.

COVID-19 has shone a spotlight on some of the wider social and economic challenges facing the UK, and a failure to tackle these will hamper the longer term recovery prospects of cities and towns in the aftermath of the pandemic. Alongside health, addressing unemployment and improving skills levels should be a priority nationally and locally – particularly for younger people.

Stewart Wilson, Government and Health Industries Leader at PwC Scotland, said:

“The latest Good Growth for Cities report examines a country clearly facing an enormous challenge, which has impacted the health and the economies of our towns and cities like nothing else in recent memory.

“The pandemic has shone a spotlight on existing economic and social inequalities. This reinforces the view that when the post-pandemic recovery begins in earnest, we must look beyond GDP and focus our collective efforts on tackling issues that really matter to the public, and their local economies, such as skilling, sustainable income and health and wellbeing.

“We need an approach which takes into account the strengths and needs of individual towns and cities to build more resilience and drive a fair recovery across the UK.”

“This year’s survey shows that Edinburgh – thanks in part to its broad spread of economic sectors – has been less impacted economically than other cities, however in line with the rest of the UK where cities hardest hit will be quickest to recover, it seems Glasgow will be quickest to emerge.”

Cities and towns with ‘Good Growth’ are more resilient

Many of the cities that perform well in the Good Growth Index – including the Scottish cities of Edinburgh and Aberdeen, and cities in England such as Norwich, Swindon, Southampton, Portsmouth and Oxford – have been relatively less economically impacted by the pandemic. Their sectoral mix and performance on broader economic and social indicators have to some extent provided resilience.

Many poorer performing cities in the Good Growth Index – including Liverpool, Southend, Medway, Doncaster and Bradford – have been hit hard by the pandemic. These cities have been more exposed to the impacts of COVID-19 and have less resilience in terms of broader economic base and social wellbeing.

An exception to this pattern is Leicester – whilst performing well in the Good Growth Index it will be one of the cities hardest hit economically by the fallout from COVID-19. Leicester was the first city to have stricter restrictions imposed following the relaxing of the initial national lockdown in June 2020. The decreased footfall in Leicester city during the summer period is likely to further reduce the performance of Leicester’s retail sector.

As the UK looks to ‘build back better’ from the pandemic, ensuring that the recovery lays the foundations for a more resilience against future shocks will be vital.

New opportunities

With more people working from home, towns and cities have new opportunities to build virtual connections and play to their strengths in terms of liveability, affordability and community. There is still much uncertainty over how these trends will play out in the long-term, however a move to hybrid home and office working does have the potential to level up certain areas of the country. PwC research shows that areas that could benefit from a shift to working from home include outer London and smaller cities like Wigan, Bradford and Blackpool.

Jonathan House, devolved and local government lead for PwC, said:

“The pandemic has led to people living their life much closer to home and the likelihood is some of these lifestyle changes will stay for the medium-term. Citizens will value different things and those places that meet those needs will be the ones that bounce back quicker. This opens up opportunities for places that have advantages in terms of liveability and community, and where ‘price of success’ factors, such as housing affordability, are less of an issue. The report sets out a series of recommendations for leaders from across national and local government, as well as the private and third sectors, as they plan their recovery strategies. This includes taking a broad approach to economic wellbeing and building resilience will be essential to create liveable vibrant places where people want to live, work and visit.”